Post by: Teresa McCully, Medicare Adviser – Silver Key Benefits

When making decisions about Medicare, most of us want to hide our heads in the sand and wish nothing would change around us! The problem is, lots of things change from year to year and your plan may be very different from the previous year! This makes it very important to spend time with a trusted adviser who can help you navigate all of the options available to you. Let’s look at an example:

Ms. Elle is turning 65 in the next six months, and she doesn’t even know that some of her Medicare options are available already! She can enroll in Medicare 3 months before her birthday, but she can choose to apply for a supplemental Medigap plan as much as 6 months prior to her birthday month! Kinda backwards but totally fine with Medicare rules. More on Medigap later.

Original Medicare part A covers your hospital charges. It also covers part of skilled nursing rehabilitation which is required after a three-day hospital stay. Part A typically has no monthly premium, but includes deductibles and co-pays.

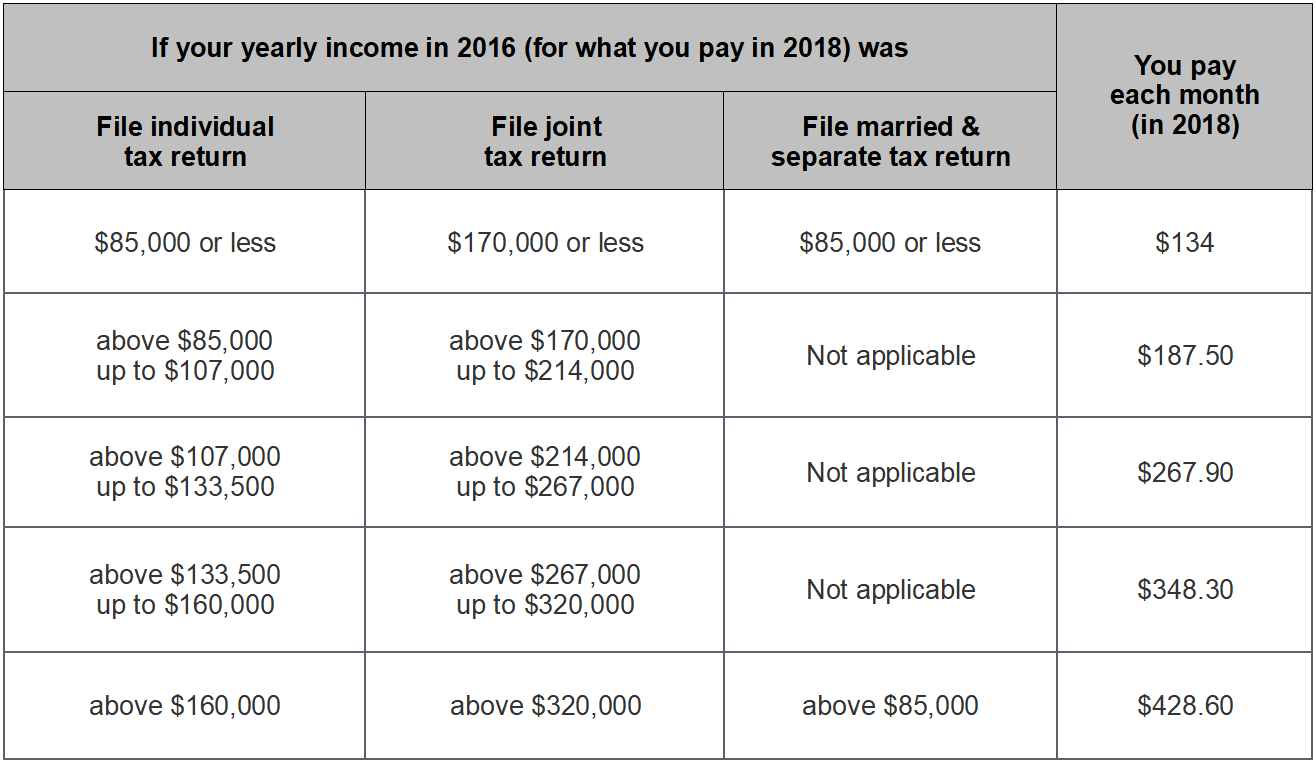

Medicare Part B covers things like your doctors, surgeons, labs or tests, surgeries and other items that are considered non-elective. The co-insurance is 80% of the bill to Medicare, leaving 20% out of pocket… with no limit to the patient. Part B has a monthly premium that typically comes directly out of your Social Security account. The approximate monthly premium ranges from $104 (for grandfathered lucky ones), to just over $135 per month (per household income as of 2018)

Source: https://www.medicare.gov/your-medicare-costs/part-b-costs

Medicare Part D, also called the Medicare prescription drug benefit, is an optional program to help cover the cost of prescription drugs. You can opt for a standalone prescription drug coverage or can enroll in Medicare Part C (also known as a Medicare Advantage plan) that includes prescription drug coverage as part of the healthcare plan. Let’s return to our example:

As an individual, Ms. Elle will pay a bit more for Medicare because her annual income of $90,000 exceeds the income level for the lowest 2018 premium. Ms. Elle should enroll in Medicare B three months before her birth month (unless her birthday is on the first day of the month in which case she can enroll the month prior.)Ms. Elle should enroll in Medicare part D the month prior to her birthday to have all her bases covered under Medicare Law.

Once you have your required enrollments taken care of, you might believe that you have all of the coverage you need. But, since there is no maximum out of pocket expense (MOOP) for Medicare, it is important to consider purchasing additional coverage (Medical Supplements) that will limit your out of pocket exposure. Let’s see if Ms. Elle’s experience can help us understand:

Ms Elle has been on Medicare for two years now. She is very healthy and sees her favorite physician who is in the Medicare network. She can see any physician in the Medicare network nationwide, so she even has coverage when she travels to see her grandchildren in the next state over. Unfortunately, as she was going to her mailbox one day, she slips and falls and breaks her hip. She has surgery and is in the hospital for four days. She is moved to skilled nursing rehabilitation for 10 days following her hospital stay since her family is out of state.

According to centers for Medicare and Medicaid CMS, Ms. Elle’s deductible at the hospital is $1340. The physician who diagnosed her charged $100 per visit making her 20% coinsurance cost $20 to see him each time. The surgeon charged $5,000 of which she paid 20% co-insurance of $1,000. Her surgery cost $50,000 of which she was expected to pay a 20$ co-insuranace of $10,000….YIKES! That’s over $12,000!

It is important to compare costs and benefits before deciding what Medicare coverage will be best for you.

Timing, Benefit Periods and Penalties

All three of Original Medicare parts, A, B and D have timing constraints and penalties attached to them if you sign up late or opt out of coverage. If you decide to continue working and have creditable coverage with your employer, you can defer Part B coverage until you no longer have creditable coverage through your employer.

- Initial Enrollment Period: You have a seven month period that begins 3 months before turning 65 (or retiring), the month of your birthday, and 3 months after your birthday, to opt in on Medicare part B via ssa.gov and avoid penalties.

- General Enrollment Period: If you miss your IEP benefit enrollment period, you will need to enroll during the General Enrollment Period (GEP) which begins January 1 and ends March 31 each year. Your coverage won’t start until July 1 of that year, and you may incur penalties.

- Penalty for late Enrollment: You may have to pay up to 10% more for each full 12 month period that you could have had Part A, Part B, or Part D coverage but didn’t sign up for it. You can avoid penalties if you can show creditable coverage through an employer or other healthcare plan.

- Part D: You may pick a stand alone Prescription drug plan aka Part D the month prior to your birthday month via Medicare.gov or agent.

- Medicare Supplements: You have 6 months prior to age 65 (or retiring), and the three months after your birthday month to enroll in a Medicare supplement aka Medigap Plan.

- Advantage Plans: If you opt for Part C (aka an Advantage Plan), you may enroll up to 90 days prior to your birth month. (Remember the birthday rule! So, if your birthday lands on the 1st, your birth month is considered the month prior.)

Working with an Insurance Adviser

Working with an insurance adviser will help you understand and navigate your benefit periods and can help you save money. An adviser will help you identify the best choices for you based on your personal situation:

Pre-existing Conditions: It is very important to understand pre-existing conditions and how they can affect your future options prior to enrolling in Medicare (particularly Part B) for the first time.

Preferred Physicians: Networks play a huge part in the flexibility of your coverage. Some plans offer lower premiums but are far more restrictive as to who you can and cannot see. They mat also charge a co-pay for each office visit. Other plans might have a higher premium, bu they perform more like “level pay” healthcare with very few restrictions on providers and little to no additional out of pocket costs as you use the plan.

Working with a local broker can help you navigate all the options available in your state. Ms. Elle’s example can help us better understand the potential benefits:

If Ms. Elle had opted for a Medicare supplement (Medigap) plan, she would not have had an additional network to worry about beyond original Medicare and would have had better coverage. Even though her supplemental Plan G monthly premiums cost about $120 per month, her total out-of-pocket expenses for the surgery and rehab would have been $0 after meeting the $183 annual deductible. Her health care “maximum out-of-pocket” MOOP would have been only $1,623! ($120 x 12 + $183 = $1,623!!) Traditional Medicare A/B/D with a Medigap supplement performs more like level pay healthcare.

If Ms. Elle had opted for an Advantage plan, she might have been able to pay a lower premium, but she would have to pay co-pays for each doctor visit or surgeon and anywhere from 10 to 20% coinsurance up to the “maximum out of pocket” MOOP. In 2018, the maximum out of pocket for Medicare Advantage plans ranged from the mid $3,000’s up to $10,000 depending on area and in / out-of-network charges). Many of these plans offer more provider flexibility and additional benefits beyond original Medicare. I.e. dental/vision/hearing/exercise classes and 24 hour call lines. So, if Ms. Elle’s had a $10,000 MOOP and coinsurance of 15%, she would have paid $7500 for the $50,000 hip surgery alone! And, that doesn’t include her physician co-pays or deductibles.

There are many options available. Sometimes, a plan that has lower premiums may have higher out-of-pocket expenses. But, you can couple your Medicare coverage with a supplemental standalone coverage option to help offset the out of pocket expenses should the need arise. Working with an agent helps hone in on what you really need as an individual.

When working with a client who is new to Medicare, my job is to look at your current health and prescriptions as well as your overall budget and income. This allows me to help you navigate to the best solution for your health care coverage needs. The GREATEST part is that you don’t have to pay extra for expert advice!

Please give me a call to better understand your Medicare options.